One of the biggest demands of the modern world is to have a bank account that gives you global accessibility and allows access through conventional means such as online platforms. If you are looking for a viable option that offers these features, getting a credit card is a good way to go. Having trouble choosing from the vast selection available? Consider getting Vijaya Bank’s VISA Classic Chip Credit Card. Here’s why:

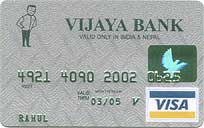

Vijaya Bank Credit Card

Out of the credit cards offered by Vijaya Bank, the VISA Classic Chip is the most feasible option for your personal transactions, precisely because of the benefits it offers. One of the most appealing features of this card is its state-of-the-art security. Equipped with a secure chip, it can prevent fraudulent transactions. Combined with the mandatory personal identification number entry with all point of sale transactions, you can rest assured that your credit card is safe from misuse and other unethical usages.

Should you lose your card and experience fraudulent uses, Vijaya bank has you covered. Your card is insured against unlawful transactions once you let the bank know of its loss.

Aside from the security it offers, you can also get a load of good deals using this card. Through the loyalty reward points system, you can earn 1 point per Rs 100 spent on your transactions. These points can be redeemed for discounts, products and services from partner establishments, helping you save money, even when spending it.

Apply for the Vijaya Bank Credit Card

To be eligible for a Vijaya Bank Credit Card, you must already be an account holder. To do that first, fill out the account opening form on the Vijaya Bank website. Once you have an account, you’ll be able to apply for a credit card, providing you meet their requirements.

At the time of applying you will be asked to present proof of income showing that you earn a minimum gross income of Rs 60,000 if you are employed or a minimum of Rs 50,000 if you are self-employed. If this is not applicable or available, you can present documents showing term deposits of Rs 50,000 within a 2-year period or more. You can also show evidence of good credit score for good measure.

Other documents the bank may require include proof of ID and proof of residence. If the bank approves your credit card application, they will determine your credit score based on your financial standing. This could be anywhere between Rs. 5,000 to Rs. 75,000.

Vijaya Bank Credit Card Fees

- Entrance fee: Rs 400

- Annual Membership fee: Rs 400

- Interest Rate: 1.75% per month

- Cash Advance: 3% of the amount withdrawn

- Overseas Transactions: 2.5%

Vijaya Bank Credit Card & Travel

The best thing about this card is it is valid globally. With 22 million merchant outlets worldwide, you can use this card all across the globe without encountering any issues. This means that you can use it for remittances, travel expenses, travelers’ cheque purchase, and many other related transactions.

With its convenience and affordability, the Vijaya Bank VISA Classic Chip Credit Card is a smart credit card choice. To avail one for yourself, start your application today by opening a bank account via the Vijaya Bank website.