Want an everyday credit card that has absolutely NO annual fees and is accepted worldwide? With a Marbles Credit Card, you won’t have to look any further. Read on to find out how you can apply for your own Marbles Credit Card…

Marbles Credit Card Features and Benefits

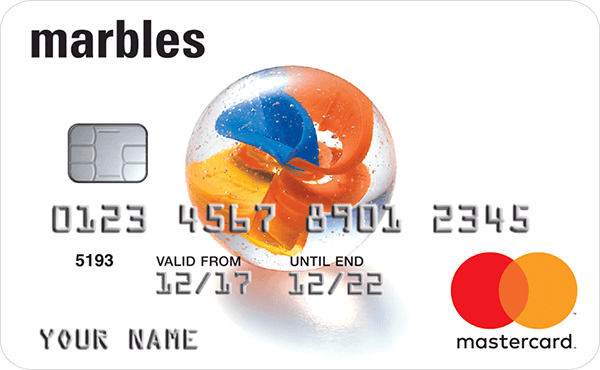

To better understand the benefits that come with owning a Marbles Credit Card, let’s take a look at one of their basic offering: The Marbles Classic Credit Card (available in Mastercard).

The Marbles Classic Credit Card is proud to offer ZERO annual fees for life! Save your hard-earned money for more meaningful purchases.

Another great privilege you can enjoy is worldwide acceptance. In partnership with Mastercard, you can make purchases and cash withdrawals wherever you are in the world. Even better, you can make transactions and purchase big-ticket items with low-interest rates!

With a security chip and a specialised PIN, you can make purchases and balance transfers more secure than ever. Whether you simply need to pay the bills, purchase items on the Internet, or need to make cash withdrawals, you know that you are in good hands. With FREE SMS alerts on your spending, you can keep track of your finances wherever you go.

Applying for a Marbles Credit Card

If you are interested in owning a Marbles Credit Card, you’ll be happy to know that applying for a Marbles Classic Credit Card is a breeze. All you need to do is apply using their online credit card application form and you can gauge your eligibility within minutes. For more information, click here.

To apply, you must be at least 18 years old, a UK resident with a UK bank account, and have a regular income.

In your application, you will be asked for your proof of billing address, proof of income, employment, and spending details. If approved, you will be given a credit limit ranging from £250 to £1,200 depending on your financial condition. This limit can be increased later on.

Marbles Credit Card Fees and Charges

Owning your own Marbles Credit Card comes with a lot of responsibility. In many ways, it is a stepping stone which you can use to build good credit. So, make sure you pay for the following fees when applicable…

- Annual Fee: £0

- Monthly Interest Rate: Ranging from 2.529% to 4.519%

- Cash Advance Charge: 3% of the amount or a minimum of £3

- Balance Transfer Fee: 3% of the amount or a minimum of £3

- Late Payment Fee: £12

- Over-limit Fee: £12

- 34.9% APR (variable, representative)

Marbles Credit Card Address & Contact

7 Handyside Street, London N1C 4DA.

Contact: 0333 220 2692

Conclusion

If you are looking for an everyday credit card that gives you excellent and secured purchasing power with low-interest rates and worldwide acceptance, apply for a Marbles Credit Card today!

Note: There are risks involved when applying for and using a credit card. Please see the bank’s Terms and Conditions page for more information.