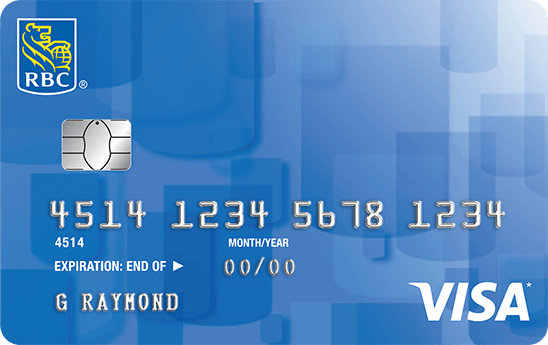

Looking for a low-interest credit card you can use for shopping, dining and other every day expenses? A Royal Bank Credit Card is all you need for unbelievably low fixed interest on purchases and cash advances. It’s the best card to have if you’re constantly on the run and want something to use for your daily expenses. For extra convenience, you can also use this credit card for purchases abroad. Read on to find out how you can apply for a Royal Bank credit card.

Royal Bank Credit Card Features & Benefits

You can do so much with a Royal Bank Credit Card. There’s a card to suit every need, whether you’re looking to get cash back rewards, travel benefits, insurance and more. In this article, let’s take a closer look at the features and benefits of the RBC Visa Classic Low Rate Option Credit Card.

For a convenient way of spending, you can carry this credit card with you instead of cash. In case you’re having a tough month, you can pay a portion of your balance and take advantage of this cards’ low-interest rate. This will help you ease your financial responsibilities while also enhancing your lifestyle.

One of the best features of this credit card is the Instant Fuel Savings which allows you save 3¢ per Liter on fuel. Not only that, but you can also earn 20% more Petro-Points at Petro Canada. Just use this card to pay for the fuel to enjoy these perks.

Speaking of perks, you also have access to a breadth of rewards from the Royal Bank of Canada. Get personalized offers to save money on shopping, dining and traveling. Simply sign up to Online Banking to get alerts on the newest promotions.

For the superior protection of the cardholders, the Royal Bank of Canada offers Zero Liability on unauthorized transactions plus Purchase Security. With the Purchase Security, you are covered for damage and loss of purchases for 90 days, from the date of purchase. You can get coverage of up to $50,000 and extended warranty insurance. This means, if you purchase an appliance with a 1-year warranty, the Extended Warranty Insurance doubles the manufacturer’s warranty up to a year.

The RBC Visa Classic Low Rate Option Credit Card is also powered by Visa, so you can enjoy worldwide acceptance and get access to a variety of Visa discounts and perks.

Apply for the RBC Visa Classic Low Rate Option Credit Card

To apply for this card online, simply visit the Royal Bank of Canada Website and click on apply now. Provide your personal and financial information to proceed. To ensure the success of your application, you must be at least 18 years old, have a steady income and a permanent address.

Note that your credit limit is determined by the Bank based on your credit history and income. If your application is successful, you can get a manageable limit between $500 to $1,500 or higher. You can also request a higher limit later on, given that you have the capacity to pay.

RBC Visa Classic Low Rate Option Credit Card Fees and Charges

- Annual Fee: $20

- Additional Card: $0

- Purchase Rate: 11.99%

- Cash Advance Rate: 11.99%

- If you choose to carry a balance on your card, the low 11.99% interest rate – on purchases and cash advances – lets you save on interest.

*Effective November 1, 2019, these rates will be changing from 11.99% to 12.99%.

RBC’s Address & Contact Details

Address: 200 Bay Street Toronto, Ontario M5J 2W7

To get in touch with RBC, call 1-800-769-2512 (or 1-514-392-9167 if you’re dialing outside North America).

Conclusion

If you’re looking for a low-interest credit card for your every day expenses, along with exclusive deals and discounts, then an RBC credit card, particularly the RBC Visa Classic Low Rate Option Credit Card is a great option. Apply today to enjoy convenience and low rates!

Note: There are risks involved when applying for and using a credit card. Please see the bank’s Terms and Conditions page for more information.