Looking for a low fee credit card that comes with a myriad of perks? Look no further because a Commonwealth Bank Credit Card is all you need to earn fantastic rewards and save money on fees.

This credit card is offered to those who want a 0% introductory rate period on purchases, as well as terms including waived annual fees in certain circumstances.

Read on to find out how you can apply for a Commonwealth Bank credit card.

Commonwealth Bank Credit Card Features & Benefits

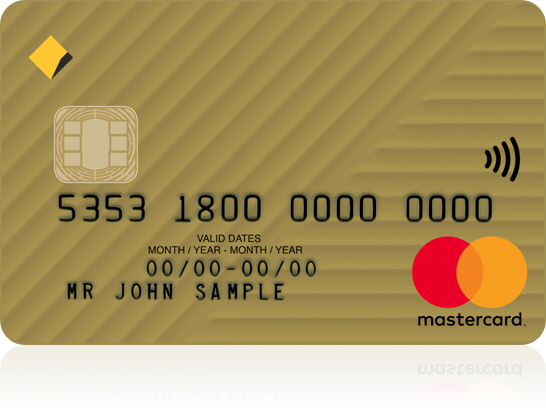

For you to better understand the perks and benefits that come with a Commonwealth Bank Credit Card, let’s take a closer look at the Low Fee Gold Credit Card.

The best thing about this credit card is the long interest-free period of 55 days. Other banks only offer up to 30 days before interest is applied. Hence, you can breathe easy knowing that the grace period is extended. Even if you miss your due date, you can expect very minimal charge, unlike other cards.

When it comes to valuable features, you can count on the Low Fee Gold Credit Card. This card comes with international travel insurance for extra protection when traveling overseas. Get coverage for travel delays, baggage and personal goods, transport expenses, rental vehicle, accidents, kidnapping and even accidental death. Not only will you get to enjoy these benefits but your family will too, given that you activate your card before you travel.

Another useful feature of the Low Fee Gold Credit Card is the extended warranty on selected purchases. You can double a manufacturer’s warranty on different appliances, gadgets and more.

If you’re constantly traveling abroad, you’ll be glad to know that this credit card is accepted worldwide. Powered by Mastercard, you’ll have access to a multitude of perks and exclusive deals.

CBA Low Fee Gold Credit Card Application

Applying for a Commonwealth Bank Low Fee Gold credit card is convenient and accessible through the online application process.

To ensure a high chance of success with your application, make sure you are at least 18 years old, an Australian resident, legally allowed to work in Australia and not currently bankrupt.

You’ll need to fill out the application form and also upload supporting documents like payslips, personal loan statements (if there’s any) and Visa details if you’re not a permanent resident yet.

For the credit limit, you can enjoy a minimum limit of $4,000.

Ready to apply? Click here.

CBA Low Fee Gold Credit Card Fees & Charges

Enjoy ZERO annual fees for the first year and the subsequent years by spending a minimum of $10,000 using this credit card. If you don’t reach the minimum required purchase amount however, you will need to settle $89.

There are other fees and rates associated, including but not limited to the following.

- APR – 19.74% (interest free up to 55 days)

- Late payment fee – $20

- Cash advance fee – $3.00 or 3.00% (whichever is greater)

- Cash advance interest rate – 21.24%

- Balance transfer rate – 5.99% for first 5 months (reverts to cash advance rate thereafter)

- Additional cardholder fee – None

Commonwealth Address and Contact Info

The Commonwealth Bank head address is located at Tower 1, 201 Sussex St, Sydney NSW 2000, Australia.

You can get in touch with Commonwealth customer service by calling +61 2 9999 3283 from overseas.

Conclusion

Overall, a Commonwealth Bank credit card, particularly the Low Fee Gold Credit Card is a truly powerful card you can use for all your daily expenses without the high fees and charges.

Order yours today to begin enjoying the perks of a Commonwealth Bank credit card.

Note: There are risks involved when applying for and using a credit card. Please see the bank’s Terms and Conditions page for more information. Note that Commonwealth’s full terms and conditions will be included in their Letter of Offer.