When it comes to managing your finances and making the most of your spending, a credit card can be a useful tool.

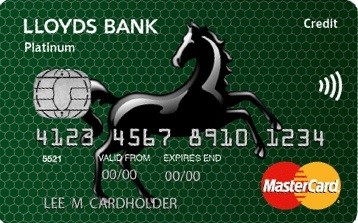

Lloyds Bank offers a range of credit card options tailored to various needs, and the Lloyds Bank Platinum Purchase Credit Card stands out as an attractive choice for those seeking to make larger purchases.

In this guide, we’ll take you through the steps of how to apply for the Lloyds Bank Platinum Purchase Credit Card, ensuring that you’re well-informed and equipped to make the right financial decision for your needs.

Checking Your Eligibility

When considering the Lloyds Bank Platinum Purchase Credit Card, it’s essential to start by assessing your eligibility. Lloyds Bank offers a user-friendly tool known as One Check Eligibility, designed to simplify this process.

The One Check tool swiftly analyzes your financial situation based on the key information you provide. This innovative tool acts as a virtual guide, showing you the specific credit card options you qualify for, along with potential credit limits and interest rates.

By offering this insight without affecting your credit score, One Check empowers you to make an informed decision, ensuring your application aligns with your financial profile.

Choosing the Right Credit Card for You

Navigating the world of credit cards begins with understanding the diverse range of options that Lloyds Bank offers. Each type of credit card is tailored to cater to specific financial needs and preferences.

Whether you’re seeking to streamline your day-to-day budgeting, consolidate existing balances, or make a significant purchase, Lloyds Bank has you covered.

Everyday Spending Credit Cards

For those looking to manage their finances with ease, Everyday Spending Credit Cards present an ideal choice. These cards are designed to align with your daily expenses, offering a low-interest rate on purchases.

Whether it’s groceries, gas, or everyday indulgences, this credit card type ensures that your budget remains intact while allowing you the convenience of credit-based transactions.

Balance Transfer Credit Cards

If you’re seeking to streamline and simplify your outstanding balances, Balance Transfer Credit Cards provide a solution.

These cards come with an introductory interest rate offer, making them particularly attractive for consolidating multiple debts into one manageable payment.

This type of credit card empowers you to take control of your financial obligations by providing a structured repayment plan.

Large Purchase Credit Cards

For larger investments and planned expenditures, Large Purchase Credit Cards offer a valuable solution.

These cards typically come with an introductory interest rate on purchases, allowing you to spread the cost of significant expenses over time.

Whether it’s a home appliance, electronics, or a vacation, Large Purchase Credit Cards provide the financial flexibility to make substantial investments without straining your immediate finances.

Features of the Lloyds Bank Platinum Purchase Credit Card

Lloyds Bank offers a variety of credit cards with distinct features and functions. In this article, we’re going to look closely at the features of the Platinum Purchase Credit Card.

Shopping for gadgets, home appliances, furniture, and other luxuries creates a big hole in your pocket, however, if you have the Lloyds Bank Platinum Purchase Credit Card, you can pay it in installments and enjoy a 0% interest rate for 20 months.

In case you often travel for work or leisure, you’ll be glad to know that this credit card is powered by Mastercard. Enjoy worldwide acceptance and leave your stash of cash at home – it’s safer.

Love discounts? You’ll get access to merchant discounts on travel, tours, car rental, and accommodation, plus other surprises, simply by using your credit card.

Transfer your balances from other banks and enjoy only a 3% balance transfer fee. Compared to other credit cards with sky-high fees on balance transfers, Lloyds Bank Platinum Purchase Credit Card only charges a minimum amount.

Lloyds Bank Platinum Purchase Credit Card Application

Applying for a Lloyds Bank credit card is a straightforward process that can be completed from the comfort of your own home. To guide you through, here’s a step-by-step breakdown of the application procedure:

- Check Your Eligibility: Before initiating the application, it’s wise to use Lloyds Bank’s One Check Eligibility Tool. This tool offers a quick snapshot of the credit cards you’re eligible for, providing insight into potential credit limits and interest rates. By utilizing this tool, you ensure that your application aligns with your financial profile.

- Select Your Ideal Card: Once you have clarity on your eligibility, choose the Lloyds Bank credit card that best suits your needs. Whether it’s a card designed for everyday spending, balance transfers, or larger purchases, understanding your financial objectives will guide your choice.

- Complete the Application Form: Fill out the application form with accurate and up-to-date information. This may include details about your employment, income, and existing financial commitments. Ensuring the accuracy of your information is crucial to the evaluation process.

- Submit Your Application: With the form completed, submit your application electronically. Lloyds Bank will then assess your application and perform the necessary credit checks to determine your creditworthiness.

Credit Status for Approval

It’s important to highlight that credit status plays a pivotal role in the approval process. Lloyds Bank evaluates your creditworthiness based on factors such as your credit history, income, and existing financial commitments.

Positive credit history and responsible financial behavior can significantly enhance your chances of approval. By maintaining a healthy credit score, you maximize your potential for a successful application.

Remember, responsible credit card usage not only secures approval but also paves the way for a healthy financial future.

APR and Charges of the Lloyds Bank Platinum Purchase Credit Card

As a responsible cardholder, you need to pay your balance on time to prevent additional fees set by the bank. One good thing about the Lloyds Bank Platinum Purchase Credit Card is there is no annual fee.

If you miss the 56-day grace period, you will be charged an APR of 19.9% (variable) and £12 as a late payment fee. For a cash advance, you are charged is £12 per transaction.

Lloyds Bank Address & Contact Details

Address: 25 Gresham St., London, UK, EC2V 7HN

To get in touch with Lloyds Bank, call 0345 602 1997 (or +44 1733 347 007 from outside the UK).

Conclusion

The Lloyds Bank Platinum Purchase Credit Card stands out as a prime example of how a well-structured credit instrument can enhance your financial prowess. As you embark on the journey of applying for this credit card, remember that knowledge is your greatest ally.

Armed with knowledge, guided by a clear application process, and bolstered by a strong credit standing, you’re poised to embark on a journey of financial empowerment and responsible credit card usage.

Your financial future awaits – embrace it with confidence and make the most of your credit card experience.

Note: There are risks involved when applying for and using a credit card. Please see the bank’s Terms and Conditions page for more information.