Travel Hacking – Credit Card Air Miles for Europeans

With today’s trillion dollar travel industry it’s no wonder why credit card companies are onto it like a hawk, constantly advancing and coming up with new cards that offer tantalising rewards such as air miles.

Nowadays it is much easier than you think to earn yourself awesome travel perks such as free flights and accommodation around the world just by using your credit card rewards system.

Rewards such as air miles are accumulated every time you spend on your credit card. Most companies offer an average of 1.5 miles to every $1 spent which is why travel hacking ‘experts’ suggest you use your credit card as much as possible, especially for purchases such as groceries, fuel, dining and bill payments.

On top of the rewards you receive from each purchase, you’ll often receive a nice little bonus in air miles or points that you can exchange for flights, accommodation, rental cars and more – just for signing up. Depending on the company and the status of your credit card, a sign-up bonus may even reward you enough to take a short break straight away!

Sounds pretty awesome right? Well, yes if you have the money to spend in the first place.

Often these types of cards come with an annual fee – some ranging up to the $300 mark, high interest rates and overseas transaction fees. Not to mention the fact that you usually have to spend over a certain amount in short period of time to receive your sign up bonus.

Due to all of these factors, you need to travel a lot to make having one of these credit cards worthwhile. The bigger your purchases are, the more air miles you can accumulate. And don’t be surprised if you find it a difficult process to redeem your points – no bank really wants to give you free money!

But this is where we get to the annoying part.

Whilst it seems that there are a number of cards on offer with amazing sign up deals and rewards on your purchases, there isn’t exactly – unless you live in the US.

After speaking with a fellow traveller recently, we came to the agreement that US citizens have it great in that respect. It’s extremely easy for them to sign up for a number of credit cards to receive generous bonus rewards that unfortunately, companies in other countries simply do not offer.

So What About ‘Travel Hacking’ For European Travellers? Is There Such Thing As Credit Card Air Miles For Europeans?

The answer is yes!

Just because you don’t live in the states, it doesn’t mean you should have to go without the opportunity to earn air miles on your purchases and travel more! Which is why I’ve done some research to figure out whether there are credit cards out there that offer rewards such as credit card air miles for Europeans.

It’s quite evident that Europe doesn’t exactly promote the idea of having a credit card which is a good thing in my view. However, it doesn’t mean they shouldn’t have them on offer for those who can afford to keep one and reap the benefits from rewards systems!

If you can afford a rewards credit card and you are a frequent traveller, they are a very good idea. They also encourage you to travel more by rewarding you for it which we’re all for!

After asking around and reading up on credit card air miles for Europeans, I came across a few different cards. While they don’t offer quite as good benefits as some of the US credit cards, I believe that having one could very well help you to accumulate enough rewards to exchange for flights, accommodation and travel around the world.

Cards vary from country to country but generally offer the same types of deals, particularly in countries using the Euro. Here I will be focusing on obtaining a rewards credit card in Belgium, however the same program (Miles & More Lufthansa – a Star Alliance member) does offer similar deals throughout many other countries in Europe.

Recommended for you: How to Save and Earn Money While You Travel Long Term

What To Look Out For When Applying For A Rewards Credit Card:

1. Your credit card rewards should always exceed the fees you pay (annual fee, currency exchange rate, transaction fees) to make having one worthwhile.

2. Your credit card should always offer flexibility to earn rewards.

3. Your credit card should also always offer flexibility to redeem your rewards.

4. Check the interest rate – often high (so it would be a good idea to pay bills on time!)

Some credit cards make obtaining miles or points easier than others. It is possible that only certain purchases at specific places will count towards your travels. And also, as I mentioned earlier, credit card companies don’t want to make it simple for you to get free stuff so redeeming your points can be difficult.

European Credit Cards That Offer Air Miles/Rewards (Case Study: Belgium)

Program: Miles & More Lufthansa (In alliance with Brussels Airlines)

Note: American Express cards have a high conversion fee of 2.5% for non-euro payments! You should only use your Brussels Airlines American Express card for euro payments.

1. American Express Membership Rewards

If you already have an American Express card, you can actually use it to accumulate air miles. In this case, it would need to be a Belgian American Express Card issued in Belgium. The same would go in Germany or France, etc.

If you use your American Express Card for all of your purchases, you can then redeem your Membership Rewards points for award miles (air miles). For every euro you spend you receive 2 Membership Rewards points, which can be redeemed for 1 award mile.

While using American Express can get very costly, the benefits could still have you winning.

To read more about it click here.

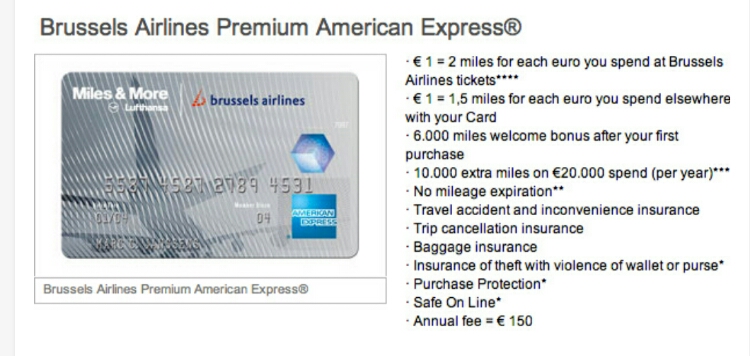

2. Brussels Airlines Premium American Express card

Named the fastest way to earn reward miles.

Annual fee: €150

Bonus: 6000 miles welcome bonus after first purchase + 2000 bonus miles if you sign up to use the card to pay your mobile phone bill + if you spend €20,000 or more in one year, you will receive an extra 10,000 award miles

Rewards: 2 miles for every €1 you spend on Brussels Airlines flights, 1.5 miles for every €1 you spend on everything else

Insurance Included: Travel accident and inconvenience insurance, Trip cancellation insurance, Baggage insurance, Insurance of theft with violence of wallet or purse*, Purchase Protection*

Cons:

- Annual fee is high (€150)

- High conversion fee (2.5%) for non-euro payments (shouldn’t use outside of Euro countries)

To read more and apply, click here.

3. Brussels Airlines Preferred American Express

Annual fee: €120

Bonus: 3000 miles welcome bonus after first purchase + 2000 bonus miles if you sign up to use the card to pay your mobile phone bill + if you spend €10,000 or more in one year, you will receive an extra 5,000 award miles

Rewards: 2 miles for every €1 you spend on Brussels Airlines flights, 1.25 miles for every €1 you spend on everything else

Insurance Included: Travel accident and inconvenience insurance, Trip cancellation insurance, Extended baggage insurance, Insurance of theft with violence of wallet or purse*, Best price coverage*, Purchase Protection*

Cons:

- Annual fee is high (€120)

- High conversion fee (2,5%) for non-euro payments (shouldn’t use outside of Euro countries)

To read more and apply, click here.

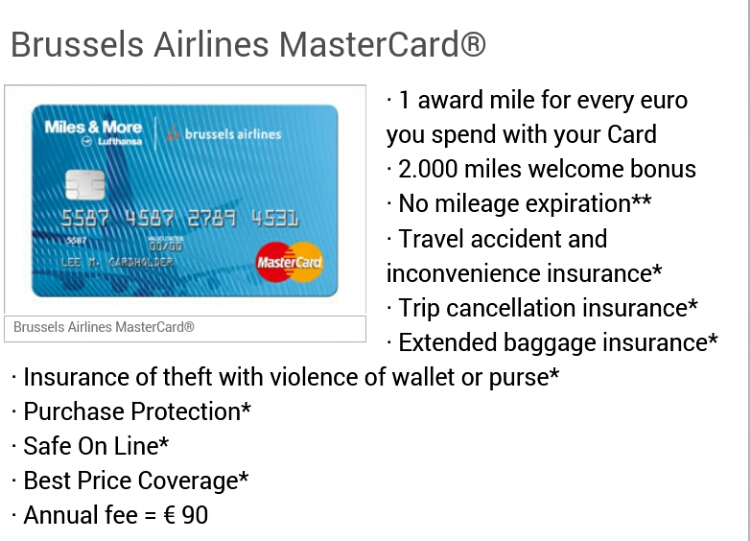

4. Brussels Airlines Mastercard

Annual fee: €90

Bonus: 2000 miles welcome bonus

Rewards: 1 miles for every €1 you spend on your credit card

Insurance Included: Travel accident and inconvenience insurance, Trip cancellation insurance, Extended baggage insurance, Insurance of theft with violence of wallet or purse*, Best price coverage*, Purchase Protection*

Cons:

- Little bonus points upon sign-up

To read more and apply, click here.

The really great thing about all these cards is that there are no payment fees involved when making purchases in Euro. However, while the cards are great for accumulating lots of points, they are expensive to use in non-euro countries. Which is why you might want to consider the next option.

Bank: BKCP Belgium

BKCP Visa Classic

While this Belgian credit card doesn’t offer the same ‘travel hacking’ benefits as the cards above, the reason why I decided to include this card was because of its many other incredible benefits for European travellers.

Benefits:

1. Withdrawing money within Euro countries is completely free! Yes you can take cash out from your credit card for free. Much like a cash loan, but cheaper!

2. Withdrawing money from anywhere else in the world is just €5.00 which is cheap considering you’re using borrowed cash.

3. When you pay in any other currency other than the Euro, there’s 0% conversion fee! That’s almost unheard of.

From what I’ve read, you need to have a BKCP bank account in Belgium to link the Visa Classic credit card to and altogether this would cost an annual fee of €57.84. The monthly limit on the card is €1250 but you can up that.

To find out more about the BKCP Visa Classic credit card click here.

Conclusion And Recommendations: Credit Card Air Miles For Europeans

Based on the research I’ve done to find out what options are out there for European travellers (in particular, those from Belgium) looking to sign up for credit cards that offer rewards such as air miles, there really isn’t a huge range out there! However, from what I know, I have a few suggestions.

1. Sign up for both the Brussels Airlines Premium American Express card as well as the BKCP Visa Classic card.

2. Use your Brussels Airlines Premium American Express card to pay for flights and all major expenses within the Euro-zone as well as online.

3. Use your BKCP Visa Classic card when travelling outside of the Euro-zone to get cash out at ATM’s and make purchases.

4. Here’s some smart advice I read from luxury traveller and travel hacker, Bart Lapers at www.travel.bart.la:

“I would recommend to sign-up for the Brussels Airlines Premium American Express card to get the 6000 miles. Complete the form to pay your cellphone bill with the card and earn an additional 2000 miles.

Next year, you could cancel the Premium card and switch to the Preferred card. You would earn the sign-up bonus again (this time for the Preferred card, which is 3000 miles) and you would earn another 2000 miles when you register to have your cellphone bills paid with the Preferred card. That’s 13,000 miles in one year, just by signing up for these cards!”

And there you go! Credit card companies that offer credit card air miles for Europeans aren’t of abundance but there are some out there. Take a look, see what option works best for you and begin accumulating those rewards to travel more!

Europe Accommodation:

Book your Europe accommodation now while it’s fresh in your mind. On Booking.com, you can find amazing Europe hotel deals with excellent reviews.

Like what you’ve read? Follow us on Facebook for more daily travel tips and inspiration!

Pin this >>

Comments are closed.